Cleaning Business Start Up Cost

Starting a cleaning business can be a lucrative venture, offering flexibility and the opportunity to build a successful enterprise. However, like any business, it comes with its own set of costs and considerations. Understanding these expenses is crucial for budgeting and planning your new venture. This article will delve into the various aspects of cleaning business start-up costs, providing a comprehensive guide to help you make informed decisions.

The Foundation: Essential Start-Up Costs

Before diving into the world of cleaning services, it’s essential to establish a solid foundation. These are the fundamental expenses that every cleaning business owner should be aware of.

Business Registration and Legal Requirements

Starting a business requires navigating the legal landscape. This includes registering your business, obtaining the necessary licenses and permits, and complying with local regulations. The cost of registration varies depending on your location and the type of business structure you choose. Additionally, you may need to invest in insurance to protect your business and clients. Liability insurance is a must-have, and you may also consider worker’s compensation and property insurance.

| License Type | Cost Range |

|---|---|

| Business License | $50 - $500 |

| Health and Safety Permits | $200 - $1,000 |

| Liability Insurance | $300 - $1,500 annually |

Equipment and Supplies

Investing in high-quality cleaning equipment and supplies is crucial for delivering excellent service. This includes vacuums, mops, buckets, cleaning solutions, and specialized tools for various cleaning tasks. The cost of equipment can vary significantly based on the brand and features you choose. Opting for durable, commercial-grade equipment may require a higher upfront investment but can save you money in the long run.

| Equipment Type | Estimated Cost |

|---|---|

| Commercial Vacuum Cleaner | $200 - $1,000 |

| Mops and Buckets | $50 - $200 |

| Cleaning Solutions | $100 - $500 annually |

| Specialized Tools (e.g., carpet cleaners, window washers) | $150 - $500 each |

Transportation and Logistics

Transporting your equipment and reaching client locations is an essential aspect of your business. Depending on the scale of your operations, you may need a vehicle specifically for business use. This could be a van or a truck, depending on the size and nature of the cleaning jobs you undertake. The cost of a vehicle can be a significant expense, so it’s important to factor this into your budget.

| Transportation Option | Estimated Cost |

|---|---|

| Vehicle Purchase (e.g., van) | $10,000 - $30,000 |

| Vehicle Rental (monthly) | $300 - $1,000 |

| Fuel and Maintenance | $100 - $500 monthly |

Marketing and Branding

Effective marketing is key to attracting clients and growing your cleaning business. This includes creating a professional brand identity, designing marketing materials, and utilizing online platforms to reach potential customers. The cost of marketing can vary widely depending on your strategy and the scale of your operations.

| Marketing Channel | Estimated Cost |

|---|---|

| Website Development | $500 - $2,000 |

| Online Advertising (e.g., Google Ads) | $100 - $500 monthly |

| Printed Materials (business cards, brochures) | $100 - $500 |

| Social Media Marketing | Variable, based on ad spend and management costs |

Operational Costs: Running Your Cleaning Business

Once your cleaning business is up and running, there are ongoing expenses to consider. These operational costs are essential for maintaining your business and delivering consistent services to your clients.

Employee Wages and Benefits

If you plan to hire employees, you’ll need to budget for their wages, benefits, and payroll taxes. The cost of labor can vary significantly based on your location and the skill level of your employees. It’s important to offer competitive wages to attract and retain quality staff.

| Employee Role | Estimated Wage |

|---|---|

| Cleaning Technician | $12 - $20 per hour |

| Supervisor | $15 - $25 per hour |

| Office Staff (if applicable) | $18 - $30 per hour |

Overhead Costs

Overhead costs are the ongoing expenses required to keep your business running smoothly. This includes rent for office space (if applicable), utilities, office supplies, and administrative expenses. These costs can add up quickly, so it’s essential to budget for them accurately.

| Overhead Expense | Estimated Monthly Cost |

|---|---|

| Office Rent | $500 - $2,000 |

| Utilities (electricity, internet, phone) | $100 - $300 |

| Office Supplies | $50 - $200 |

| Administrative Expenses (accounting, legal fees) | Variable |

Maintenance and Repairs

Cleaning equipment and vehicles require regular maintenance and occasional repairs. These costs can be unpredictable, so it’s essential to set aside a budget for unexpected expenses. Regular maintenance can help prevent major breakdowns and extend the lifespan of your equipment.

| Maintenance Expense | Estimated Annual Cost |

|---|---|

| Equipment Maintenance | $200 - $1,000 |

| Vehicle Maintenance | $500 - $2,000 |

| Repairs (emergency) | Variable |

Taxes and Accounting

As a business owner, you’re responsible for various taxes and accounting fees. This includes income taxes, sales taxes, and payroll taxes. It’s essential to understand your tax obligations and budget for these expenses accordingly. Consider hiring an accountant or using accounting software to manage your finances effectively.

| Tax Type | Estimated Annual Cost |

|---|---|

| Income Tax | Variable, based on business income and personal tax bracket |

| Sales Tax | Variable, based on sales revenue and local tax rates |

| Payroll Tax | Variable, based on employee wages and tax rates |

Scaling and Growth: Expanding Your Cleaning Business

As your cleaning business grows, you’ll encounter new opportunities and expenses. Scaling your operations requires careful planning and budgeting to ensure sustainable growth.

Expanding Service Offerings

Diversifying your service offerings can attract a wider range of clients and increase your revenue potential. This may involve investing in new equipment and training for specialized cleaning services, such as carpet cleaning, window washing, or upholstery cleaning. The cost of expanding your services can vary significantly based on the type of service and the equipment required.

| Specialized Service | Estimated Investment |

|---|---|

| Carpet Cleaning | $500 - $2,000 (equipment) |

| Window Washing | $300 - $1,000 (equipment) |

| Upholstery Cleaning | $800 - $3,000 (equipment) |

Business Growth Strategies

To scale your business effectively, you’ll need to invest in growth strategies. This may include hiring additional staff, expanding your marketing efforts, or investing in technology to streamline operations. The cost of growth strategies can be significant, so it’s crucial to plan and budget carefully.

| Growth Strategy | Estimated Cost |

|---|---|

| Hiring Additional Staff | Variable, based on wage rates and number of employees |

| Expanded Marketing Campaigns | $1,000 - $5,000 monthly |

| Technology Investments (e.g., scheduling software, CRM) | $500 - $2,000 annually |

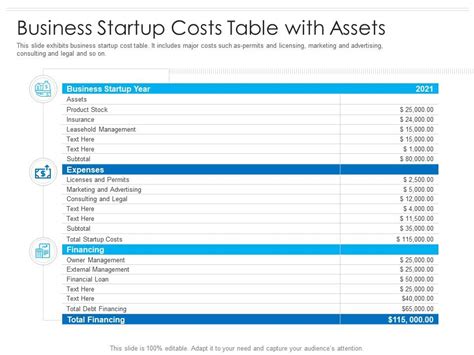

Financial Planning and Cash Flow Management

Effective financial planning and cash flow management are crucial for the long-term success of your cleaning business. This involves creating a detailed budget, tracking expenses, and forecasting future financial needs. It’s essential to have a clear understanding of your financial situation to make informed decisions and avoid cash flow issues.

| Financial Planning Task | Frequency |

|---|---|

| Create a Detailed Budget | Annually, with quarterly updates |

| Track and Analyze Expenses | Monthly |

| Forecast Cash Flow | Quarterly |

Conclusion: A Comprehensive Guide to Cleaning Business Start-Up Costs

Starting a cleaning business requires careful planning and consideration of various costs. From initial start-up expenses to ongoing operational costs and growth strategies, each aspect of your business has financial implications. By understanding these costs and developing a robust financial plan, you can set your cleaning business up for success and achieve your entrepreneurial goals.

How much does it cost to start a cleaning business from scratch?

+The cost of starting a cleaning business can vary significantly based on factors such as location, scale of operations, and equipment choices. On average, you can expect to invest between 5,000 and 20,000 for initial start-up costs, including business registration, equipment, and marketing.

What are the key expenses I should budget for in the first year of my cleaning business?

+In the first year, focus on budgeting for essential expenses like business registration, insurance, equipment, marketing, and initial staffing costs. These expenses are critical for getting your business off the ground and establishing a solid foundation.

How can I manage ongoing operational costs effectively?

+Effective cost management involves regular expense tracking, budgeting, and identifying areas where you can save or optimize costs. Consider negotiating with suppliers, exploring cost-saving measures like shared workspaces, and focusing on efficient marketing strategies to control costs.

What are some common mistakes to avoid when budgeting for a cleaning business?

+Avoid underestimating costs, especially for equipment, marketing, and employee wages. Overlooking maintenance and repair expenses can also lead to unexpected financial burdens. Additionally, be cautious of overspending on marketing without a clear strategy and ROI measurement.